From waste to fuel: is biomethane the providential solution for decarbonizing transport?

The transport sector is extremely energy-intensive and polluting in France. There is a need to decarbonize it, in order to meet the target of reducing greenhouse gas emissions by 55% by 2030 compared to 2005. Electrification and hydrogen are much emphasized, but we must not overlook the importance of biomethane, which could, if it lives up to its promise, supply 10% of the transport sector’s demand in 2030 and 25% in 2050! This biofuel would also make it possible to recover waste, which could become a source of income for municipalities rather than a burden and contribute to the emergence of a local circular economy. An article by Pierre-Emmanuel GUILHEMSANS-VENDÉ, R&D Consultant in D&S team at TNP Consultants.

Transport, a very energy-intensive sector

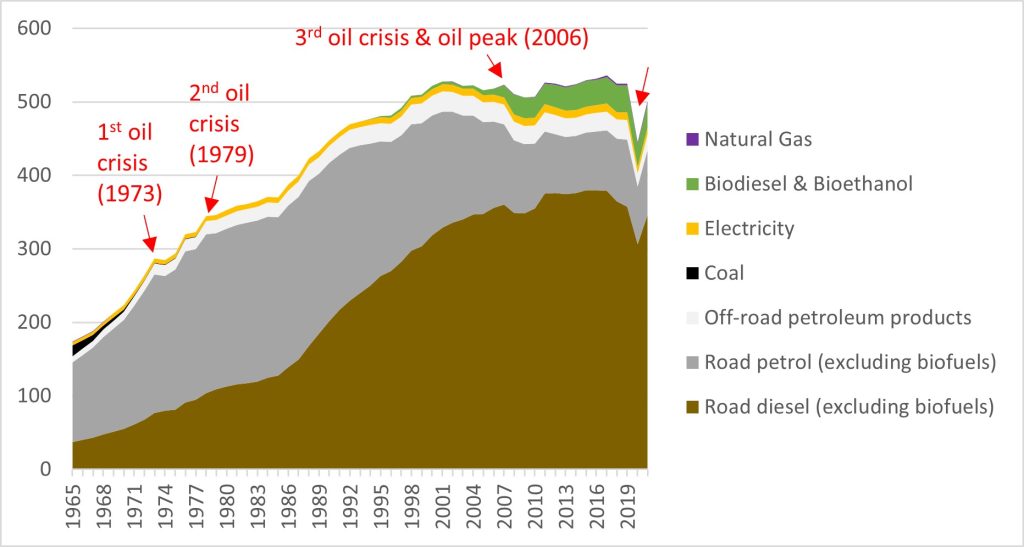

Since 1965, final energy consumption in the transport sector in France has increased threefold, from 174 TWh to 525 TWh [1] (seeFigure 1).

Figure 1 – Final energy consumption of the different fuels used in transport in France (1965-2021)

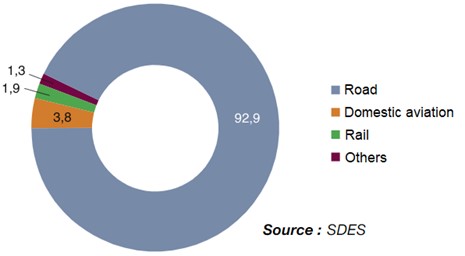

In 2019, 93% of this energy consumption was due to road transport (passengers & freight) and 91% to fossil fuels (see Figures 1 and 2). Moreover, 31% of greenhouse gas (GHG) emissions in France come from transport, corresponding to 136 Mt CO2eq, with road transport contributing 93% of these emissions (53% cars, 25% heavy goods vehicles, 15% commercial vehicles).

Figure 2 – Modal shares of transport in final energy consumption in 2019

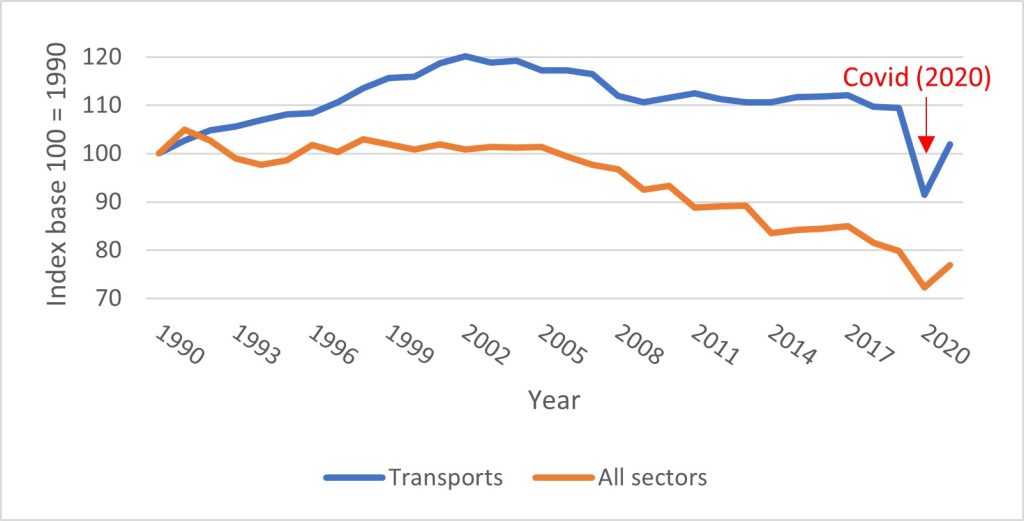

On a positive note, the number of vehicles on the road in France has increased fourfold since 1965, which, compared to the increase in energy consumption, means that the energy efficiency of combustion engines has increased by a third in half a century. However, this is not enough: in 30 years, nothing has reduced GHG emissions from transport, apart from Covid, which, by limiting travel, reduced emissions by 10 % compared to 1990 levels. Otherwise, in a business-as-usual situation, transport emissions have stagnated at 10% above 1990 levels since 2008 [2], in contradiction with the Kyoto Protocol and now Fit for 55 (see Figure 3). This trend also runs counter to the trend for all sectors, where emissions have fallen by 23% between 1990 and 2021. But Fit for 55 aims to reduce the EU’s GHG emissions by 55% by 2030 and more generally to achieve carbon neutrality by 2050. There is therefore a real need to decarbonize the transport sector, especially as one of the measures in Fit for 55 would be to extend the European carbon compliance market to maritime and road transport.

Figure 3 – Evolution of French GHG emissions overall and in transport

In view of this necessary decarbonization, several solutions exist:

- Electrification, particularly for high-speed rail lines, trams, and trolley buses

- Electric batteries, for cars and buses

- Biofuels (bioNGV, bioethanol, biodiesel, hydrogenated oils) for cars, buses, freight trucks, and sea and air transport

- Hydrogen, mainly seen as a solution for heavy transport and captive fleets (non-electrified long-distance rail, air, maritime, road freight and public buses), as it is not competitive with batteries for individual and/or short-distance transport.

Biofuels, a major solution to decarbonize transport

Biofuels represent an interesting alternative to decarbonize transport in the short term because they allow the reuse of existing infrastructure. They also enable a significant reduction in GHG emissions when used: for example, biodiesel produced from used cooking oil emits 84% fewer GHG emissions [3].

However, biofuels get bad press because they are mainly associated with land grabbing at the expense of food. This statement is partially true if we consider first-generation biofuels (biodiesel, bioethanol), which consume rapeseed, maize, sugar cane, wheat, soya, sunflower, and beet, and which, in the case of bioethanol, require 3% of French agricultural land [4]. However, there are some nuances: the production of B100 biodiesel by the company Oleo100 from French rapeseed is not in competition with food because one third of national production is sufficient to saturate the French market (the rest can be used to produce bioethanol). B100 by Oleo100 is already running 5,000 trucks today, and eventually, according to Oleo100, their biodiesel would be enough to fuel 10% of the trucks in France (~50,000 trucks). But Oleo100 remains an exception because in 2019, biodiesel imported all its raw materials – 60% of which came from Europe – whereas the bioethanol consumed in France was mainly produced locally (83% of raw materials, hence 3% of cultivated land). Another drawback of first-generation biofuels is their energy return on investment, often referred to as EROI – the ratio of energy produced to energy spent (infrastructure construction, extraction, maintenance, dismantling) over the entire life cycle. So that the exploitation of an energy source (oil, wind, sun, biomass, uranium, etc.) is not an economic and energy aberration, EROI must be greater than 1.3, and ideally, for environmental reasons and to be able to maintain our current standard of living, it would be preferable for EROI to be greater than 3 [5].

However, first-generation biofuels often have EROIs between 0.7 and 1.3 (exceptions exist with EROIs of 4 to 7). Since an EROI of less than 1 means that the energy needed to produce the fuel is greater than the energy that will ultimately be consumed, these fuels are neither viable nor sustainable!

Second-generation biofuels, made from waste products1 (agricultural and forestry residues, domestic waste), solve some of the problems of first-generation biofuels. For example, these types of biofuels do not compete with food, use previously unexploited waste, and have higher EROIs ranging from 2 to 11. For the time being, biomethane is the only second-generation biofuel available on the market.

Biomethane, a solution for the future

Natural gas of fossil origin and biomethane have virtually the same composition, which gives the advantage of being able to easily share the same network infrastructure and address the same uses. However, they differ in the way they are produced:

- Natural gas is generated from the sedimentation of organic matter. This natural process takes a long time – several million years – and is therefore non-renewable on a human scale. Thus, natural gas is a resource that does not release GHGs into the atmosphere on a short cycle but rather on a long cycle.

- Biomethane is produced from inputs (agricultural residues, household waste, sewage plant sludge, etc.). The process is carried out over a short period of time (a few weeks) and from inputs that are themselves renewable: it is therefore a renewable energy (RE). Furthermore, the biomethane production process avoids the emission of GHGs from organic matter (manure, waste) as well as those linked to the production of industrial fertilizers. Here, there is a notion of valorization of a resource that would have emitted GHGs over a short cycle.

Thus, the carbon content of biomethane is 5 to 10 times lower than natural gas – 227 g CO2eq/kWh LHV2 – and comparable to other renewable energy sources.

The life cycle assessment study carried out by Quantis – ENEA in 2017 “Evaluation of the GHG impacts of the production and injection of biomethane into the natural gas network” evaluates the carbon content of biomethane based on the standard LCA method at 23.4 g CO2eq/kWh LHV. This value, which integrates the GHG emissions linked to its life cycle, as well as the reductions in GHG emissions obtained by methanization in the agricultural and waste treatment sectors, reflects the impact of biomethane on the climate.

The Base Carbone ® administered by ADEME uses a value of 44.4 g CO2eq/kWh LHV, assessed using another LCA methodology that does not take avoided impacts into account. It is intended for use in the specific framework of the Base Carbone. It is an average value representative of the French generation mix.

Biomethane production processes

Biomethane can be obtained by three different processes: methanization, pyro gasification and methanation.

Methanization is a process of fermentation of organic matter, whether plant or animal (such as agricultural inputs: manure, slurry, crop residues, intermediate energy crops, inputs from the food industry: fats, beet pulp, animal by-products, etc., or urban waste: household waste, biowaste from restaurants, sewage treatment plant sludge, grass clippings, non-hazardous waste landfills, etc.), which, when deprived of oxygen, produce biogas. This biogas is then purified to produce biomethane, so that its composition is as close as possible to that of natural gas (at least 97% methane).

Pyro gasification or gasification, which also includes hydrothermal gasification, is a thermochemical solution to produce solid, liquid, or gaseous fuels from organic matter. Depending on the pressure and temperature conditions, the process can be oriented towards the production of synthesis gas or syngas. From this syngas, biomethane can be obtained by methanation, a process for reforming methane from hydrogen and carbon dioxide or carbon monoxide, not to be confused with methanization.

As an example, we can cite the GAYA R&D platform, located in Saint Fons (in France’s Auvergne Rhône Alpes region) and managed by ENGIE, whose demonstrator uses the principle of pyro gasification and produces renewable gas injected into the gas network.

Power-to-gas (PtG) is a process that converts electricity into synthetic gas. The electricity must be of renewable origin for the gas produced to be considered renewable energy. The first step is an electrolyzer producing hydrogen. A second step can be added to convert the hydrogen into methane via a methanation reaction.

Power-to-gas is a response to the intermittency of non-storable, renewable electrical energy production: the principle is to convert renewable electricity into hydrogen, which can then be converted into injectable synthetic methane or injected directly into the gas network: this is what is being tested, for example, in the GRHYD and JUPITER 1000 projects.

The production costs for each of these methods, taking into account resource supply costs plus processing costs, are as follows:

- Methanization, with costs below €80/MWh HHV

- Pyro gasification with costs between €80 and 120/MWh HHV

- Power-to-gas with costs between €65 and €184/MWh HHV, depending on the pathway.

The power-to-CH4 option is in the range of €105-184/MWh HHV, but it is important to note that this cost also considers an average CO2 supply cost of €10/MWh HHV. Power-to-H2 allows for a significant cost reduction to €65 – 125/MWh HHV.

Biomethane production potential in France

If we combine all the potential for methanization (algae, bio-waste, agrifood industry (AFI) residues, livestock manure, grass, intermediate crops, crop residues), gasification or pyro gasification (wood from the forest, sawmill/black liquor by-products, wood from outside the forest, wood waste, Solid Recovered Fuel (SRF) and fatal H2) and power-to-gas, we arrive at a primary resource of 616 TWh, of which 152 TWh comes from methanization, 257 TWh from gasification and 207 TWh from power-to-gas. Considering the conversion efficiencies as a function of production type (94% for methanization, 70% for gasification and 66% for power-to-gas), there would be an injectable gas potential of 460 TWh HHV, with 143 TWh from methanization (~30%), 180 TWh from gasification (~40%) and 136 TWh from power-to-gas (~30%).

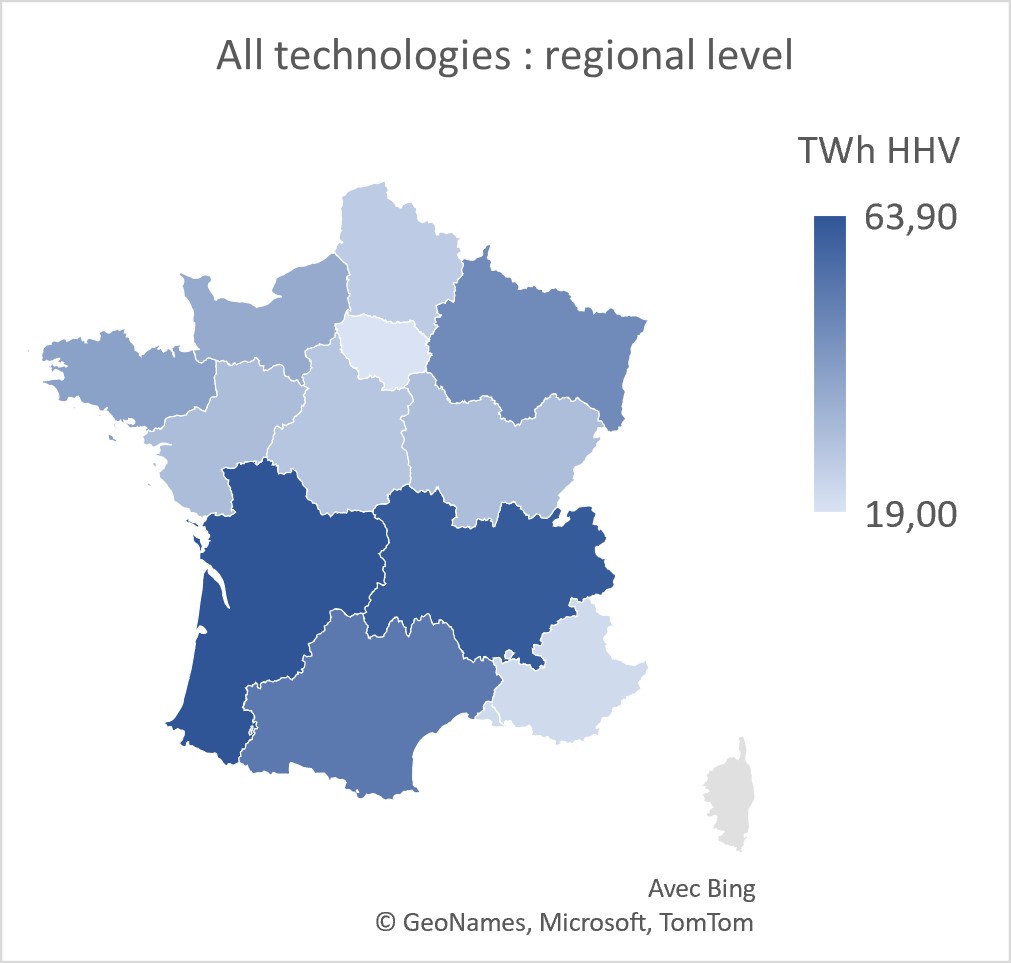

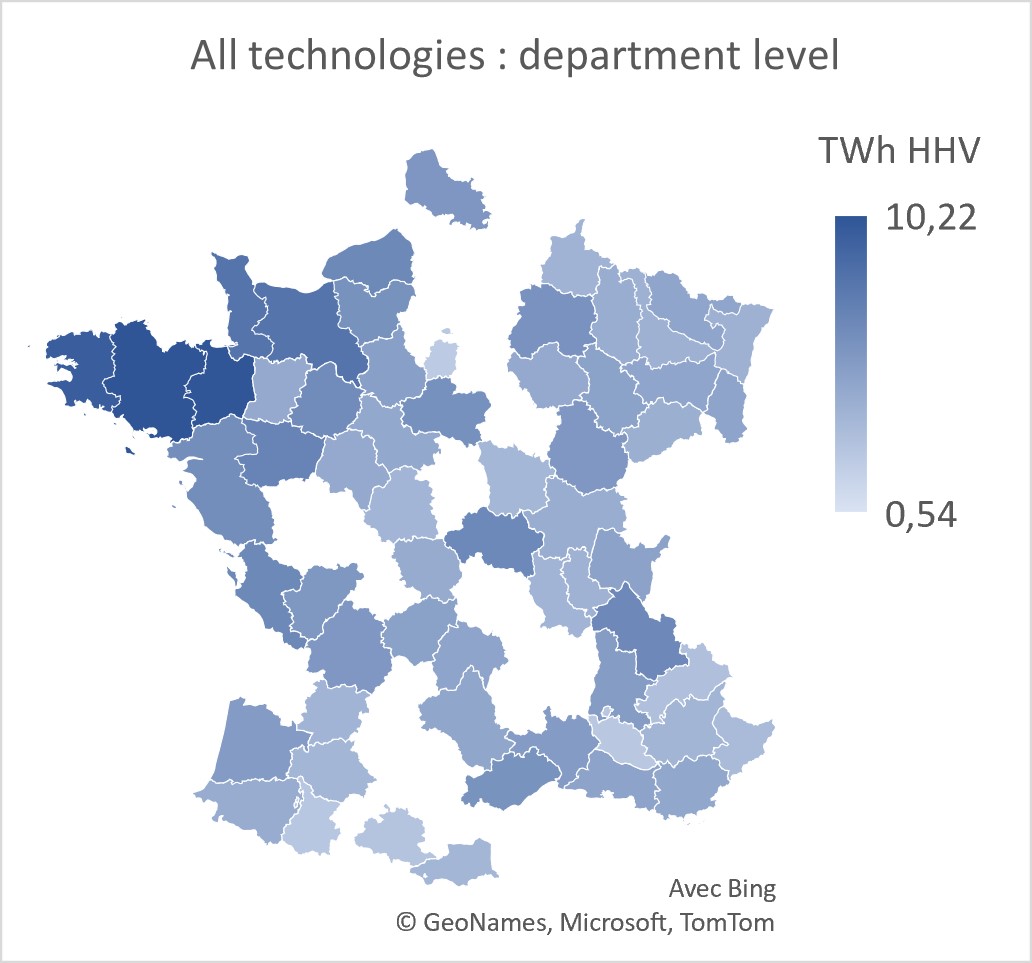

Figure 4 – Overall biomethane production potential at departmental and regional level

The 460 TWh HHV of biomethane production is not evenly distributed. Thus, overall, the four departments of the Brittany region are those with the highest potential, followed by the Puy de Dôme. Brittany alone has a potential of 40 TWh, i.e. about 9% of the total potential in mainland France, even though it represents only 5% of the surface area of mainland France. But if we look at the regional scale, the situation is quite different: all technologies taken together, the two regions with the largest deposits are Nouvelle Aquitaine and Auvergne Rhône Alpes, although they do not stand out on the departmental map.

In the context of requests for projects, the administrative scale (departmental or regional) will therefore have a significant weight for a methane production project in terms of production potential (essentially methanization for the moment).

In any case, according to Emmanuel Uwandu, founder of Gas360 and an expert in the field, the development of biomethane by regions or municipalities will bring many benefits. Biomethane will be a source of revenue (sales of municipal waste to biomethane producers, taxes), will create local jobs, will help achieve greenhouse gas reduction targets, will contribute to better waste management promoting a circular economy and may even guarantee, in some cases, a certain energy independence. Moreover, according to Mr. Uwandu, methanization will not compete with composting in the management of organic waste, which will become compulsory for professionals, local authorities, industrialists and individuals starting on December 31, 2023, in application of the 2020 anti-waste law: the two will even be complementary.

Nevertheless, GRDF, GRTgaz and Teréga, all professionals in the gas industry, agree that a realistic production trajectory for biomethane available for injection in 2050 would be 320 TWh, including 130 TWh from methanization, 100 TWh from gasification (50 from pyro gasification and 50 from hydrothermal gasification) and 90 TWh from methanation [6].

However, the ADEME, in its 2035-2050 energy visions, forecasts an overall decrease of 32% in energy consumption in the transport industry by 2030, from 495 TWh in 2018 to 337 TWh in 2030 [7]. At the same time, according to the Teréga report, Perspectives 2022, gas (hydrogen and methane) should supply 34 TWh of transport energy demand in 2030 (i.e. 10% of demand) and 114 TWh in 2050, i.e. at least one third of demand. Thus, although hydrogen vehicles are much talked about in the news, in the third of vehicles running on gas in 2050, more than three-quarters will be running on biomethane!

For the moment, in France, biomethane production and injection capacity is 10.83 TWh, distributed among 607 methanization sites [8], and the number of CNG vehicles in circulation is approximately 32,000 [9]. There is therefore a long way to go before we reach 320 TWh of biomethane production and 5 to 10 million CNG vehicles in 2050. However, other means of producing biomethane are being studied and could help develop the sector: these are third-generation biofuels based on the cultivation of micro-organisms such as algae, yeast, or bacteria. Biomethane thus has good development prospects, especially since, although this article has focused mainly on transport, biomethane will also make it possible to decarbonize district heating and electricity production in gas-fired power stations.

Sources

[1] Commissariat général au développement durable, “Bilan énergétique de la France pour 2020,” Service des données et études statistiques (SDES), Jan. 27, 2022.

[2] Commissariat général au développement durable, “Émissions de gaz à effet de serre du transport,” Chiffres clés transports 2022, Mar. 2022.

[3] European Parliament and Council of the European Union, “Directive (EU) 2018/2001 of the European Parliament and of the Council of 11 December 2018 on the promotion of the use of energy from renewable sources.” Dec. 21, 2018.

[4] “Biocarburants,” Ministères Écologie Énergie Territoires. https://www.ecologie.gouv.fr/biocarburants (accessed Oct. 17, 2022).

[5] C. A.S. Hall, S. Balogh, and D. J.R. Murphy, “What is the Minimum EROI that a Sustainable Society Must Have?,” Energies, Jan. 23, 2009.

[6] Teréga, GRDF, GRTgaz, and SPEGNN, “Perspectives Gaz : Vers un territoire national neutre en carbone en 2050 avec 100 % de gaz renouvelables et bas-carbone.” 2022.

[7] E-Cube Strategy Consultants, “Marché français des biocarburants.” Feb. 2019.

[8] Open Data Réseaux Énergies (ODRÉ), “Observatoire de la filière biométhane.”

[9] Association Française du Gaz Naturel Véhicules (AFGNV), “Véhicules GNV en circulation en France.”