Decarbonizing Air Transport: What Are The Alternatives To Hydrogen?

In 2021, IATA set a target of zero net CO2 emissions by 2050. Hydrogen seems to be the miracle solution, but in reality this energy carrier will not be available for at least 15 years and will not be enough to decarbonize the sector. So, what are the alternatives while we wait for hydrogen? By Pierre-Emmanuel GUILHEMSANS-VENDÉ, R&D Consultant at TNP Consultants, and published in Air & Cosmos magazine (november 2023).

In the space of 2 years, the covid crisis has profoundly transformed the global economic balance, particularly affecting the airline industry, which was at a standstill for several months. At the General Assembly of the International Air Transport Association (IATA) from October 3-5, 2021, the 295 member airlines representing 82% of world traffic committed themselves to achieving the objective of zero net CO2 emissions by 2050. The covid was a real electroshock, responsible for losses of $180 billion in 2020 and 2021 [1], revealing the devastating potential of a pandemic on the global economy, but above all revealing the fragile balance of the planet’s ecosystem, which has been severely disrupted by human activity.

With this in mind, how does IATA intend to achieve this net zero objective, when the sector’s annual growth is forecast at 4% [2] and the number of passengers is set to increase fivefold between 2021 and 2050?

Hydrogen, a long-term alternative

Hydrogen is the most widely publicized solution for decarbonizing the aviation sector, promoted in particular by the following initiatives: Airbus’s ZEROe aircraft, Pratt&Whitney’s liquid hydrogen engine, H2FLY’s HY4 prototype, ZeroAvia’s plans for a hydrogen line between the UK and the Netherlands by 2024, and French airline Amelia’s plans to convert its ATR 72s to hydrogen [3], [4]. Hydrogen could reduce in-flight greenhouse gas (GHG) emissions – which account for 84% of the aviation sector’s emissions – by 75-90% compared with conventional fuel [5]. But this spectacular reduction would only be possible if the hydrogen were obtained by electrolysis of water using low-pollution electricity sources, such as nuclear or renewable energies. This is what is known as “low carbon” hydrogen. However, given the lack of maturity of this technology, the high cost of hydrogen (linked to the complexity of its production process) and the limited availability of low-carbon hydrogen (only 4% of production at present), hydrogen will not be the miracle solution for decarbonizing air transport in the short and medium term.

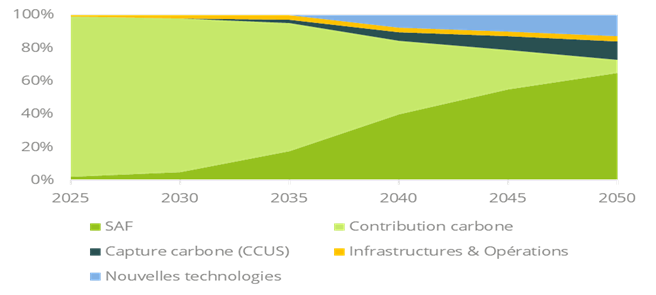

IATA considers that hydrogen will contribute less than 1% in 2035 and 13% in 2050 to the decarbonization of the aviation sector, along with other new technologies such as hybrid electric aircraft, battery-powered aircraft and new, more fuel-efficient aerodynamic designs (see Figure 1).

So, in the short term, the main sources of contribution to the decarbonization of the aviation sector will come from the massive incorporation of sustainable aviation fuels (SAF), synthesized from biomass and/or waste and from carbon offsetting or contribution, via the purchase of carbon credits (protection and restoration of forests, marine ecosystems and/or peat bogs).

Carbon offsetting, an initial short-term alternative

Until 2040, the carbon contribution option will be predominant. At present, the cost of carbon credits is limited on the voluntary carbon markets (1 carbon credit, i.e. 1 t of CO2 equivalent, is worth €4). However, according to a report by BloombergNEF (BNEF)[7], the price of carbon credits is set to rise sharply in 2029 or 2031 to more than €200, mainly due to a major imbalance between supply and demand. Based on the data in this report on the price of carbon credits between 2021 and 2050 and cross-checked with the targets for the purchase of carbon credits over the same period, it can be estimated that carbon contribution, corresponding to the purchase of 21.2 billion carbon credits between now and 2050, will cost airlines around €3,000 billion. How will this be reflected in the price of a ticket, and therefore in the prices paid by passengers? Based on forecasts for growth in the annual number of passengers, the carbon contribution will cost less than €10 per ticket up to 2035 and between €10 and €20 from 2035 to 2050.

SAF as the second alternative that can be rapidly deployed

In 2022, 450,000 commercial flights, or 1.3% of the 33.8 million flights, used SAF[8]. This corresponds to consumption of around 450 million liters, or 0.12% of the 360 billion liters of fuel used worldwide in aviation. SAF currently makes it possible to reduce GHG emissions by 70%. To meet IATA’s targets for the use of SAF, production will have to be increased by a factor of 18 by 2025 (8 billion liters) and by a factor of 1,000 by 2050 (449 billion liters)! These global targets are ambitious, but IATA has not put in place a mechanism of constraint and control to ensure that these targets are met.

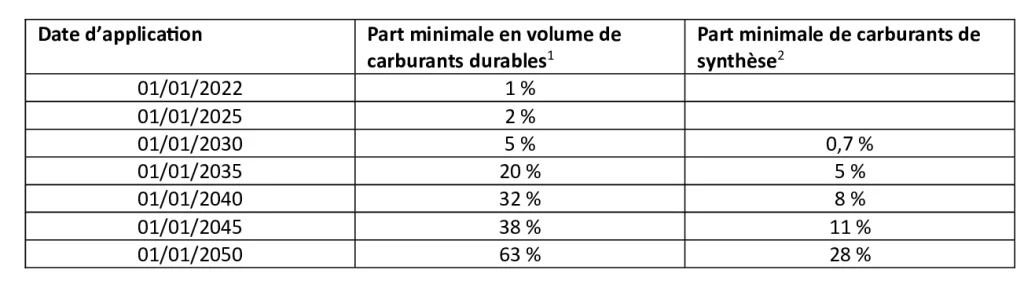

In contrast, and as is often the case, the EU has set mandatory targets for the proportion of alternative fuels used by its airlines, as shown in Table 1.

¹Sustainable fuels: SAF, low carbon hydrogen obtained by electrolysis of water using low-pollution electricity sources, methane obtained by methanation (not methanization)

²Synthetic fuels: low carbon H2 electrolysis + CH4 methanation

³Figure 1 – Sources of contribution to decarbonization of the aviation sector from 2025 to 2050 [6]

⁴Table 1 – Proportion of mandatory alternative fuels in the EU from 2022 to 2050 [9]

These targets are broadly equivalent to those submitted by IATA, with a larger share devoted to biomethane and hydrogen. The EU has set a fine for failure to meet the targets equal to 2 times the difference between the price of the alternative fuel and the price of the conventional fuel. So, knowing that traditional fuel costs €400/t and SAF costs €1,500/t, this would mean a fine of €2,200/t of SAF not produced and consumed. If IATA imposed this fine worldwide, the fine for not achieving the 1% SAF target by 2022 would be €5.54 billion instead of the €2.64 billion cost of producing the missing 3.3 billion liters of SAF! The repercussions on ticket prices are obviously not negligible: for Air France KLM/Transavia, the 1% of FAS will generate an additional cost of €30 million, increasing the price of a ticket by €1 to €4 in economy class and €1.5 to €12 in business class, depending on the distance travelled. The Fédération Nationale de l’Aviation et de ses métiers (FNAM) fears that fares will rise by 15-20% because of SAF. However, it is in the interests of European companies to exceed the targets set by the EU. Within 10 years, the EU will set a minimum tax of €10.75/GJ for conventional fuel, €5.38/GJ for 1st generation biofuels (e.g., bioethanol, biodiesel or biofuel oil) and €0.15/GJ for 2nd generation biofuels (biomethane, hydrogen [10]. For Air France KLM/Transavia, simply meeting the 5% SAF target will mean paying a tax of between €600 million and €1.2 billion, when this money could have been used to finance at least 20 to 40 % more SAF. In addition, European companies could benefit from potential sources of funding for SAF and other sustainable fuels via:

- Calls for projects with a price guarantee;

- Tax credits to compensate for the higher cost of SAF compared with kerosene for injections beyond the incorporation obligations;

- The EU ETS Fund, a European compensation mechanism to subsidize the incorporation of SAF at no extra cost compared with kerosene (at global level, CORSIA).

Other development opportunities in the EU

Decarbonizing the aviation sector will require a high level of electrification, with an energy requirement in 2050 of 12,000 TWh [11]. By way of comparison, current world electricity production is 27,000 TWh. This will require colossal investment to make a successful transition from oil to low-carbon electricity: 4 to 9 times more investment.

However, according to Vincent Etchebehere, Director of Sustainable Development and New Mobilities at Air France, electric and hydrogen technologies for aircraft will only be used on short and medium-haul flights. Moreover, mass marketing will not take place for at least another 50 years. Nevertheless, these remain future decarbonization levers that Air France-KLM (AFKLM) is considering. In addition, AFKLM has clear decarbonization targets, validated by a scientific benchmark, the Science B. Target Initiative (SBTI) since the end of 2022. AFKLM has set a target of -30% GHG emissions per passenger and per km by 2030 compared with 2019. To achieve this, AFKLM is relying on several levers, including fleet renewal (40% A350 by 2025 and 70% by 2030, with an investment level of €1m/year), the use of SAF (3 agreements signed with DG Fuels, Neste and TotalEnergies for 2.4 million tons), the development of intermodality (partnerships with the SNCF, for example) or the optimization of fuel consumption on each flight (weight reduction, eco-piloting, optimization of trajectory via AI or the use of electric traction on the ground instead of the aircraft’s combustion engines).

In this aviation context, France and the EU will probably be ahead of the rest of the world in its decarbonization trajectory. This could represent an opportunity in terms of the dynamism of the employment market and its attractiveness to non-EU countries, provided that outsourced production is limited, particularly in Asia, and that as much production as possible is repatriated to Europe (reindustrialization). In any case, decarbonizing this sector will take a long time and will inevitably lead to an increase in ticket prices, due to the heavy investment required in terms of carbon contribution, fuel substitution, electrification and adaptation of airport structures.

This raises two issues. On the one hand, will the EU manage to limit this rise in fares through various subsidy mechanisms? Will the airline industry have to establish partnerships with other transport players (road, sea), or even new players, to pool their investment efforts? On the other hand, will users accept this increase because of an awareness and a feeling of social responsibility in line with their values? Or will the increase be considered too high and limit access to air transport to the most affluent? The answer to these questions will inevitably condition the development of air transport over the next 3 decades.

Sources

[1] IATA, “Airlines Cut Losses in 2022; Return to Profit in 2023,” Dec. 06, 2022.

[2] World Aviation, “Aviation industry growth forecast 2040,” Jan. 28, 2022.

[3] “L’avion à hydrogène, le futur de l’aviation durable ?,” Aéroaffaires, Mar. 03, 2022.

[4] “Avion à hydrogène,” Wikipédia. Jan. 01, 2023.

[5] J. Hilotin et al., “Hydrogen-powered aircraft? What we know so far,” Mar. 30, 2022.

[6] IATA, “Net Zero Resolution.” Jun. 2022.

[7] “Carbon Offset Prices Could Increase Fifty-Fold by 2050,” BloombergNEF, Jan. 10, 2022.

[8] IATA, “Net zero 2050: sustainable aviation fuels.” Jun. 2022.

[9] Commission Européenne, “Proposition de règlement du Parlement Européen et du Conseil relatif à l’instauration d’une égalité des conditions de concurrence pour un secteur du transport aérien durable.” Jul. 14, 2021.

[10] Commission Européenne, “Révision de la directive sur la taxation de l’énergie (DTE),” European Commission – European Commission.

[11] Institut Montaigne, “Aviation décarbonée : embarquement immédiat.” Jan. 2022.